How much data is enough?

We are often asked by clients how much data is enough for AI analysis. People may have low confidence on…

Health insurers incur large financial losses to fraud, waste, and abuse in its claims. According to The National Health Care Anti-Fraud Association (NHCAA) in the United States, annual cost of fraudulent health claims is more than USD 300 billion. While there are no reliable statistics on the size, it is believed that up to 10% or more claims are lost to FWA activities. This figure is believed to be much higher in some Asian markets.

Health insurers incur large financial losses to fraud, waste, and abuse in its claims. According to The National Health Care Anti-Fraud Association (NHCAA) in the United States, annual cost of fraudulent health claims is more than USD 300 billion. While there are no reliable statistics on the size, it is believed that up to 10% or more claims are lost to FWA activities. This figure is believed to be much higher in some Asian markets.

To detect FWA, most insurers rely heavily on rules from experience or expert judgements. These static, reactive rules need to be manually reviewed, maintained, and updated regularly to keep pace with constantly evolving fraud schemes and patterns. This maintenance process is labour intensive and is rarely timely enough. In recent years, while machine-learning based predictive models have been used to detect FWA, these types of models frequently rely on learning from historical fraud cases. However, one key problem is that most insurers haven’t accumulated meaningful list of historical fraud cases for the machine to learn from. A natural consequence of these approaches is that it always lags behind new FWA schemes.

Relacio represents an innovation of AI tool that breaks through the limitations of existing tools. We look for FWA activities by studying the data directly without human intervention. Virtually all types of FWA can be potentially detected, whether you have seen it or not in the past.

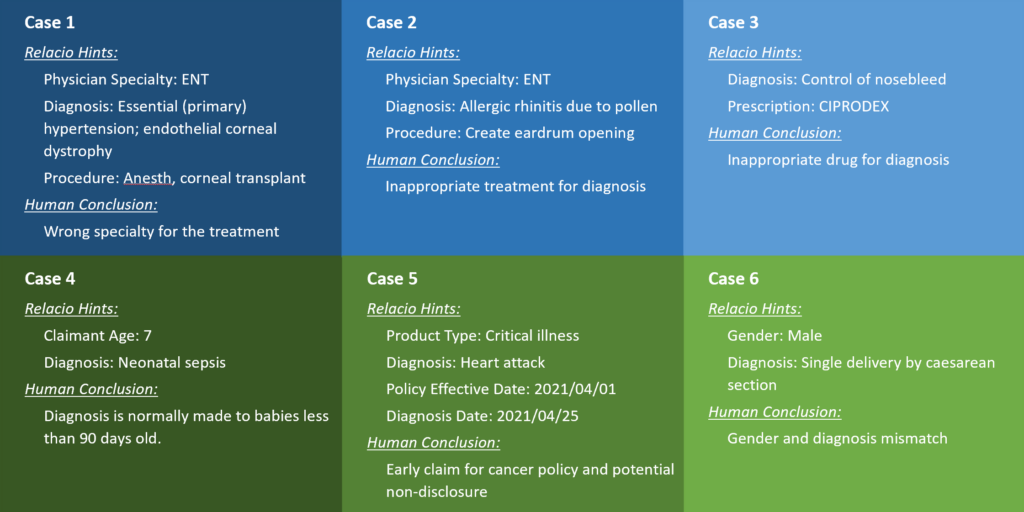

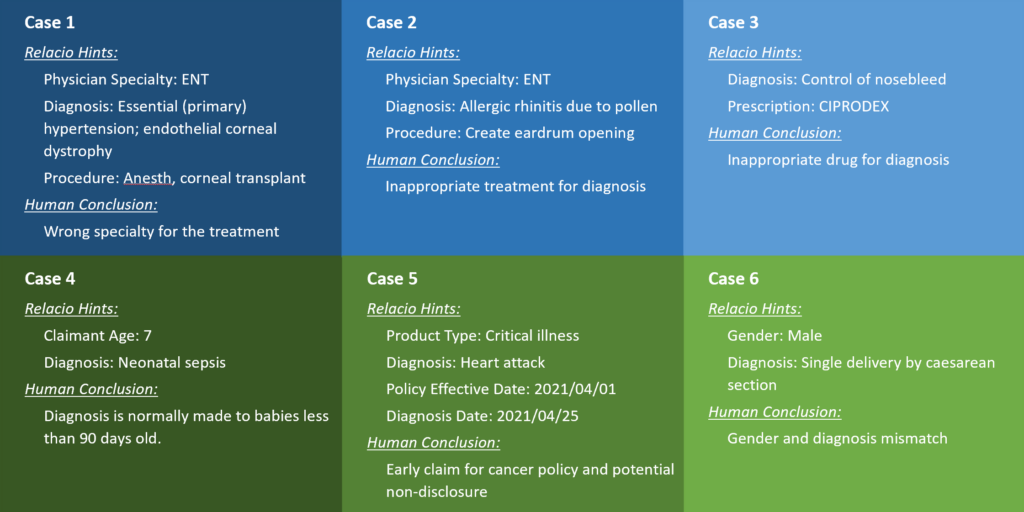

Some of the examples Relacio uncovered and brought to human’s attention are provided as follows. Relacio found these cases without any prior knowledge or human intervention.

Relacio is like a robot let loose on your data, made for the “lazy” humans, who do not need to tell it where and how to look for troubles.

Health insurers incur large financial losses to fraud, waste, and abuse in its claims. According to The National Health Care Anti-Fraud Association (NHCAA) in the United States, annual cost of fraudulent health claims is more than USD 300 billion. While there are no reliable statistics on the size, it is believed that up to 10% or more claims are lost to FWA activities. This figure is believed to be much higher in some Asian markets.

To detect FWA, most insurers rely heavily on rules from experience or expert judgements. These static, reactive rules need to be manually reviewed, maintained, and updated regularly to keep pace with constantly evolving fraud schemes and patterns. This maintenance process is labour intensive and is rarely timely enough. In recent years, while machine-learning based predictive models have been used to detect FWA, these types of models frequently rely on learning from historical fraud cases. However, one key problem is that most insurers haven’t accumulated meaningful list of historical fraud cases for the machine to learn from. A natural consequence of these approaches is that it always lags behind new FWA schemes.

Relacio represents an innovation of AI tool that breaks through the limitations of existing tools. We look for FWA activities by studying the data directly without human intervention. Virtually all types of FWA can be potentially detected, whether you have seen it or not in the past.

Some of the examples Relacio uncovered and brought to human’s attention are provided as follows. Relacio found these cases without any prior knowledge or human intervention.

Relacio is like a robot let loose on your data, made for the “lazy” humans, who do not need to tell it where and how to look for troubles.

We are often asked by clients how much data is enough for AI analysis. People may have low confidence on…

In the age of big data and AI, companies are re-discovering the value of their data. British mathematician Clive Humby…

Insurance product mis-selling is one of the key and consistent themes that regulators everywhere place a hawkish eye on. Mis-selling…